According to the Arizona Department of Transportation, there are nearly 40,000 registered golf carts operating on public roads statewide. For Casa Grande residents wondering whether they can drive their golf cart to the local store or around the neighborhood, the answer is yes—but only when specific legal requirements are met. This guide covers everything you need to know about golf cart road laws in Casa Grande, including registration, insurance, equipment requirements, and where you can legally drive.

What Arizona Law Says About Golf Carts on Public Roads

Arizona state law permits golf carts on public roads under specific conditions. Since Casa Grande follows Arizona state regulations without additional municipal restrictions, understanding state law is essential for any golf cart owner.

According to Arizona Revised Statutes, a golf cart is defined as a vehicle weighing less than 1,800 pounds, with at least three wheels, a maximum speed of 25 mph, and seating for no more than four passengers. This definition determines which rules apply to your vehicle.

The Arizona Department of Transportation confirms that golf carts can legally operate on public roads where the posted speed limit is 35 mph or less. This restriction exists because golf carts typically reach maximum speeds of only 20-25 mph, making them unsafe on faster roadways.

Many Casa Grande neighborhoods feature 25-35 mph speed limits, making them potentially suitable for golf cart use. However, major thoroughfares like Florence Boulevard have higher speed limits and prohibit golf cart operation.

Registration Requirements for Street-Legal Golf Carts in Casa Grande

Before driving your golf cart on any Casa Grande road, you must register it with the Arizona Motor Vehicle Division. This process transforms a recreational vehicle into a street-legal Low Speed Vehicle (LSV).

According to the Arizona MVD, registration requires:

- A completed Arizona title and registration application

- Manufacturer’s Certificate of Origin or existing title

- A 17-digit Vehicle Identification Number (VIN)

- Proof of Arizona liability insurance

- Payment of applicable title and registration fees

Upon successful registration, you will receive Arizona license plates that must be displayed on your golf cart. The MVD also issues a title proving your legal ownership.

For golf carts without a standard VIN, the registration process requires a Level 1 vehicle inspection at an MVD office, law enforcement location, or certified third-party facility. The Arizona serial number assigned during this process becomes your official VIN.

Insurance Requirements: Protecting Yourself and Others

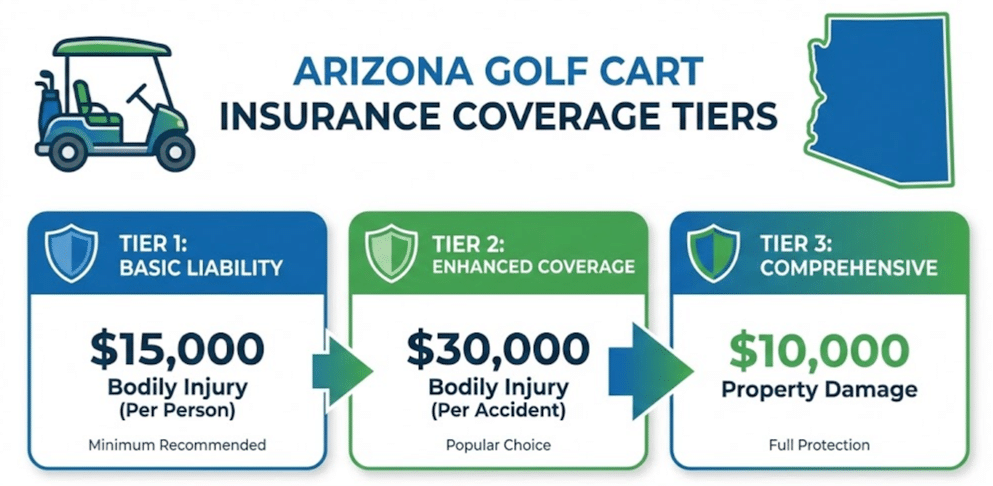

Arizona law requires all golf cart drivers on public roads to carry the same minimum liability insurance as standard vehicle operators. According to the Arizona Department of Transportation, the minimum coverage requirements are:

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $15,000 property damage liability per accident

This coverage protects you if you cause injury or property damage while operating your golf cart. Driving without proper insurance can result in license suspension and expensive SR-22 insurance requirements for three years.

Standard auto insurance policies typically do not cover golf carts. According to insurance industry guidelines, golf cart owners should purchase a separate golf cart insurance policy tailored to the unique risks of operating these vehicles.

Golf cart insurance policies can include liability coverage, collision coverage, comprehensive coverage for theft or weather damage, and medical payments coverage. Many insurance providers offer specialized policies for these vehicles at reasonable rates.

Required Safety Equipment for Street-Legal Operation

Arizona law requires specific safety equipment before a golf cart can legally operate on public roads. According to the Arizona MVD, your golf cart must have:

- Working headlights for visibility

- Functional taillights

- Brake lights that illuminate when stopping

- A horn audible from a reasonable distance

- Rearview mirrors

- Turn signals

- Proper braking system

Interestingly, Arizona exempts golf carts from the windshield requirement that applies to other motor vehicles. However, many golf cart owners choose to install windshields for added protection from Arizona’s sun, wind, and debris.

For golf carts classified as Neighborhood Electric Vehicles (NEVs), additional requirements include seat belts for all occupants and reflectors for enhanced visibility.

Where You Can and Cannot Drive a Golf Cart in Casa Grande

Understanding where golf carts are permitted helps you avoid citations and stay safe. Based on Arizona state law, here are the rules for Casa Grande:

Permitted Areas:

- Residential streets with posted speed limits of 35 mph or less

- Within master-planned communities and neighborhoods

- Near golf courses (incidental road crossing)

- Private property with owner permission

Prohibited Areas:

- Roads with speed limits exceeding 35 mph

- Sidewalks (designated for pedestrian use only)

- State highways and major arterials

- The side of the road (unless permitted by specific local ordinance)

Golf cart drivers must obey all standard traffic laws, including stopping at stop signs, yielding to pedestrians at crosswalks, and following traffic signals.

Driver’s License Requirements

Operating a golf cart on any public road in Casa Grande requires a valid Arizona driver’s license. According to Arizona law, this means you must be at least 16 years old and hold a Class D license or higher.

On private property, such as golf courses or gated communities, license requirements may be relaxed. However, many golf courses restrict cart operation to drivers aged 14 and older.

Anyone caught operating a golf cart on public roads without a valid license faces the same penalties as driving any other vehicle unlicensed.

Golf Cart Safety: Understanding the Risks

Golf cart accidents present serious safety concerns that every owner should understand. According to data from the Arizona Department of Transportation, there were 234 golf cart accidents over a recent three-year period in Arizona, resulting in 183 injuries and 9 fatalities.

Research published in the American Journal of Preventive Medicine found that golf cart-related injuries increased by more than 130% over a 17-year study period nationally. The study identified that approximately 38% of injuries occurred when occupants fell from the vehicle, often during turns.

The National Highway Traffic Safety Administration reports that 52% of golf cart injuries over a 10-year period resulted from occupants being ejected. Among injury victims, 35% sustained head injuries, with children three times more likely than adults to suffer traumatic brain injuries in golf cart accidents.

These statistics highlight why proper insurance coverage is essential for protecting yourself and your family.

How to Make Your Golf Cart Street Legal: Step-by-Step

If you own a golf cart and want to legally drive it on Casa Grande roads, follow these steps:

Step 1: Ensure Your Golf Cart Meets Equipment Requirements Install all required safety equipment including headlights, taillights, brake lights, turn signals, horn, and mirrors.

Step 2: Obtain Vehicle Inspection Schedule a Level 1 inspection at an Arizona MVD office or authorized third-party provider if your cart lacks a standard VIN.

Step 3: Purchase Liability Insurance Contact an insurance provider to obtain at minimum the state-required liability coverage. Working with a local independent agency like Gebhardt Insurance Group allows you to compare rates from multiple carriers.

Step 4: Register with Arizona MVD Bring your inspection documentation, proof of insurance, and completed application to the MVD. Pay applicable fees to receive your license plates and title.

Step 5: Display License Plates Attach your Arizona plates to the golf cart before operating on any public road.

Protecting Your Investment with Proper Coverage

Given the risks associated with golf cart operation and the financial consequences of accidents, comprehensive insurance coverage provides essential protection. As your hometown insurance agency serving Casa Grande since 2004, Gebhardt Insurance Group can help you find appropriate golf cart coverage at competitive rates.

Our team shops more than 40 carriers to find coverage that fits your needs and budget. Whether you need basic liability to meet legal requirements or comprehensive coverage protecting against theft, weather damage, and collisions, we can help you find the right policy.

Conclusion

Golf carts can legally be driven on many Casa Grande roads when you meet Arizona’s registration, insurance, and equipment requirements. By registering your cart with the MVD, maintaining proper liability insurance, installing required safety equipment, and restricting your driving to roads with speed limits of 35 mph or less, you can enjoy the convenience of golf cart transportation while staying compliant with the law.

Ready to protect your golf cart with proper insurance coverage? Contact Gebhardt Insurance Group at (520) 836-3244 or visit our Casa Grande office at 719 E. Cottonwood Lane for a free quote.

FAQ SECTION

Q: Do I need a license to drive a golf cart in Casa Grande?

A: Yes. Arizona law requires a valid driver’s license to operate any golf cart on public roads. You must be at least 16 years old with a Class D license.

Q: What is the maximum speed limit for roads where golf carts are allowed?

A: Golf carts can only operate on roads with posted speed limits of 35 mph or less according to Arizona state law.

Q: Does my regular car insurance cover my golf cart?

A: Typically no. Standard auto policies usually exclude golf carts. You should purchase a separate golf cart insurance policy for proper coverage.

Q: Are windshields required on street-legal golf carts in Arizona?

A: No. Arizona specifically exempts golf carts from windshield requirements, though many owners install them for added protection.

Q: What are Arizona’s minimum insurance requirements for golf carts?

A: Arizona requires $25,000/$50,000 bodily injury liability and $15,000 property damage liability—the same minimums as standard vehicles.